The Transformation of Surface Transforms Plc

From R&D proving ground to scale supplier to major automotive OEMs

Listed on London Stock Exchange, AIM - ticker SCE.

Share Price £0.4515 / 45.15p

Diluted Market Cap. at c. 195m shares and approximately 11m options, £93m

Introduction

Surface Transforms Plc creates high performance carbon ceramic brake discs for cars. They have spent many years researching, developing, and proving their products in the market. Recently they have secured sizeable orders from major automotive OEMs, resulting in a lifetime contract value pipeline of over £180m at July 2022, since then they have secured a further contract with estimated lifetime revenue of £13m. Having visited the factory I have become convinced the transformation into a scale supplier to the automotive industry is for real. The market is attractive, being a duopoly with Brembo-SGL, very high technical barriers to gain entry and customer trust, and growing with tailwinds from EV adoption and emerging concern regarding brake dust pollutant, the product has clear advantages vs iron rotors and is likely to become more prevalent on cars over time.

The Past - Product development and proving ground

It must be recognised up-front that Surface Transforms has been listed on London Stock Exchange AIM since 2002, initially raising capital at 90p / share and having 9.4m shares resulting in a market capitalisation of c. £8.4m. 20 years later and while the market capitalisation has grown to £93m, shares outstanding has grown to 195m, and alas the share price only stands at c. 45p.

To date the company has achieved limited sales of c. £1 - £2m per year, mainly to low volume high performance car manufacturers and aftermarket parts. Whilst incurring significant research and development spend to develop the product, and capital expenditures to increase production capacity. The cash required to do this has been funded by shareholders in various capital raises, most recently raising £19.1m after fees in January 2021 at 50p / share. For detailed history see the annual reports since 2003 available here.

The key achievement of the company has been the development of very high performance carbon ceramic disc brakes, and proving their product in the market. Understandably it can take a long time to convince major automotive OEMs to trust a crucial safety & performance component such as the brake discs to a new entrant. Their first major OEM customer was Koenigsegg for the CCX model in 2009, which has allowed them to prove their product in the market over many years. Since 2010 they have supplied after-market upgrade kits for various high performance cars (such as for Porsche, Ferrari, Aston, Nissan).

Product & Market

The market is a duopoly with Surface Transforms and the main player being Brembo SGL Carbon Ceramic Brakes, a joint venture between leading brake company Brembo S.p.A. and SGL Carbon. My understanding is the annual market is c. EUR 300m, and is nearly entirely supplied by Brembo-SGL. While Brembo-SGL are clearly a formidable competitor, there is room for Surface Transforms whose discs can compete technically and also ensure automotive OEMs avoid monopolistic supply.

Main product advantages vs iron disc technology are providing improved brake performance, removal of brake “fade” due to operating well at high temperature, lower weight (an unsprung component), longer lifespan (should last entire life of a normal road vehicle). Some of their advantages are relevant as the world moves towards Electric Vehicles (EV): often EV’s are very high performance heavy vehicles and therefore need high performance brakes; low weight is a priority; iron discs can develop surface rust when not used such as when the driver uses regenerative braking whereas carbon ceramic discs do not. One of the main pollutants from a vehicle after the combustion engine is brake dust, which is relevant for combustion engine and electric vehicles alike, the EU is looking at whether to address brake dust as part of the Euro 7 regulations.

Alongside the adoption of EV’s and further focus on reducing pollutants the market for carbon ceramic discs is expected to grow significantly. Surface Transforms estimate a £2bn / year potential market, I understand this is estimated using various assumptions around what type / value of car will adopt carbon ceramic discs on which axles. In summary, the market is not huge at the moment, but is expected to grow substantially, with clear product and market drivers.

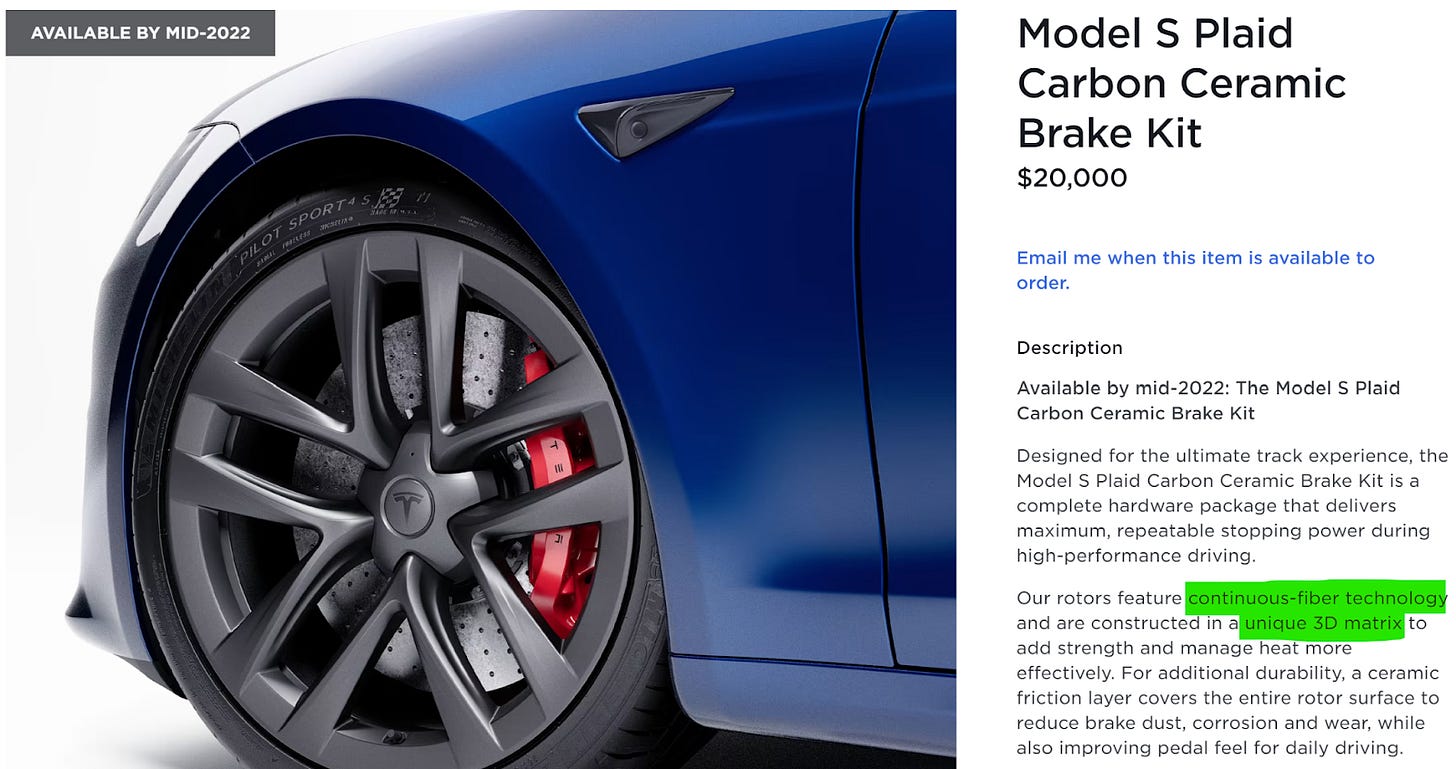

The key difference between Surface Transforms carbon ceramic disc and competitor conventional products is the use of woven continuous carbon fibre to create a 3D matrix, vs conventional products using chopped / discontinuous carbon fibre. This difference leads to a stronger, more durable product, with better heat conductivity - in turn meaning smaller discs can be used for similar brake performance. I would note that Brembo-SGL has now released “Ceramic Ceramic Wafer – DYATOM™” which I understand in practical use would produce similar performance to the Surface Transforms product.

Carbon ceramic discs are a premium product, applied to high value cars, this helps to insulate the company from wider supply chain issues (auto manufacturers prioritise delivery of their higher value cars), and gives higher confidence in their announced contracts as often the end car is limited in supply rather than volume being fully driven by demand (as on lower value cars).

In short, they have a top quality product in an attractive growing market, currently dominated by one supplier.

The Present - Major OEM orders, production scale-up

Recently the company has had fantastic success in winning various orders from major automotive OEMs. This has resulted in a lifetime contract value pipeline of over £180m at July 2022. Order details:

The (nice to have) current challenge is to scale production to meet the demand. The capital raised in January 2021 is being used to obtain £50m / year revenue capacity in 2023, this is better than the anticipated £35m / year due to a change from production cells to a plant wide “single production” line approach. Note that the factory has capacity for £75m / year revenue capacity, with “reduced” capex required to achieve this level.

After many years of limited revenues and losses Surface Transforms should move to profitability for FY 2022, exiting with substantial run-rate revenue of approximately £20m. Per the July 2022 update:

the Board is therefore pleased to restate the guidance provided in the Chairman's report in the 2021 preliminary results; "The Company continues its journey to profitability in 2022 and remains confident that this goal will be achieved, whilst maintaining our commitment to environmental and social goals."

This is a major step-change in revenue with 2022 exit run-rate being c. 8x FY 2021 revenue. The prior maximum annual revenue was £2.4m achieved in FY 2021, H1 2022 has seen revenue of £2.9m, but H2 2022 should see closer to £11m.

The Future - Expectations, margins

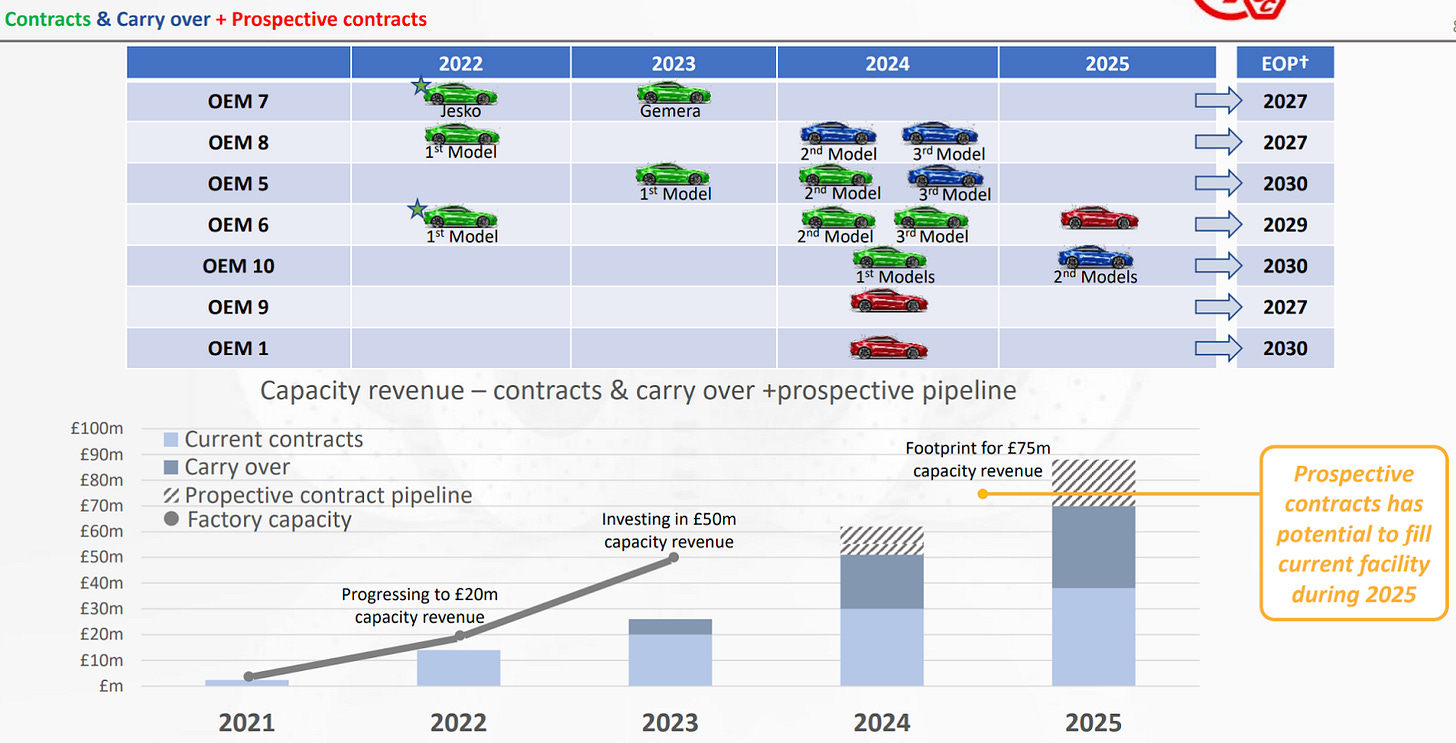

Market expectations are basically based upon the confirmed current contracts (not yet updated for latest OEM 9 contract win) and aftermarket repeating sales. This is the light blue bar in the chart below, taken from the June 2022 AGM presentation. While the market expectations imply huge growth, they are quite conservative as nothing is included for either “carry over” models or prospective contracts in the pipeline. Carry over refers to future models from a manufacturer with an existing contract - my understanding is they are effectively pencilled in to be used on these models, so it is theirs to lose effectively.

The approximate materiality of carry over models can be seen below - this indicates there is substantial scope to exceed current market expectations over the next few years.

While the next few years are unlikely to pan out without any surprises, the bigger picture is that the company is very well placed to grow in a market where demand is plentiful, as one of only two suppliers. Therefore there is big potential in the outer years.

Margins and product cost structure are expected to be healthy, with indication of 20% operating profit margin in years 2024 & 2025. My understanding is that there are huge opportunities to reduce costs in the current production process, which was primarily devised to ensure product quality. Gas is a key input in the production process, they have fixed price supply until May 2023, if energy costs tripled this would reduce gross margin by 5 percentage points, however they anticipate production improvements to offset this by 2023.

Could key customer OEM 8 be Tesla?

The company is not allowed to disclose many of their customers, hence the “OEM X” monikers applied. However, there is a fairly widespread view that OEM 8 is in fact Tesla. A few pointers:

It is a major clue that the carbon ceramic brake kit described on Tesla’s website (link & annotated screenshot below) matches key elements of Surface Transforms product description (link & annotated screenshot below), such as “continuous-fiber technology” and a “3D matrix”:

Described as “global vehicle manufacturer” which fits for Tesla, as opposed to various other customers described as British, German etc. See June 2022 AGM presentation:

finnCap described the OEM 8 contract as being for a “very high performance derivative of a current model as standard fit on both axles”, this sounds very much like the Model S Plaid. Currently the Model S Plaid only has optional carbon ceramic brakes, but given the criticism that the standard fit brakes receive, it is not hard to envisage Tesla moving to standard fit for this ultra high performance model.

Clearly needs to be a relatively high volume model / manufacturer given the value of the contract, and in strong demand per commentary.

Financials & Capital requirements

The company is expected to hit profitability for FY 2022, however the strong growth outlook will require significant capex and working capital. They are funded to obtain £50m revenue capacity per year, however they need to prepare in advance for future sales, therefore I would anticipate them looking at how to maximise the current factory capacity soon (£75m / year). I would estimate this increase may require capex of £15m. With gross cash at H1 2022 at £6.7m, down £6.3m from £13.0m at FY 2021 year end (both balances include £3m irrevocable letter of credit for furnaces), this will likely need to be raised from shareholders within the next year. Conservatively we could assume issuing 30m shares (approx. 15% dilution) at 50p / share (same price as January 2021 raise), however given the substantial progress since January 2021 I would hope the price would be significantly higher, and thus the dilution lower.

The balance sheet is quite clean, with £1.6m of debt at FY 2021 year end.

Catalyst, Downside, Upside

This company has been listed on AIM for c. 20 years, with limited revenues and losses - the key catalyst for this investment is that FY 2022 (particularly H2) is when they finally deliver substantial production volume revenues, and move to profitability. Although this is forecast, the actual delivery of it will likely cause the market to take notice. There is inherently a lot of potential for a successful company in this space.

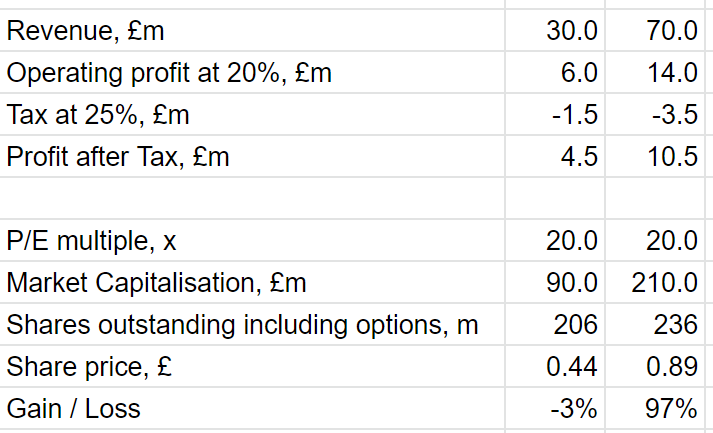

Surface Transforms is a small company with big customers, with contracted demand currently quite concentrated with OEM 8, this brings big potential but also risk. I think the product they have developed has substantial value, but in the short term there is significant downside if there was to be any issue with a major customer. Outside of this concern, the main downside protection comes from the view that they are now already operating at significantly higher production rates than previously, and essentially the business should be valued as a real scale/scaling operation. Through this lens I would suggest downside should be limited from this level. If we assume that they achieve £30m revenue run-rate by 2024 / 2025 (being the 2024 forecast excluding any carry on or prospective contracts, excluding recent OEM 9 contract win), this may sound optimistic but is not a huge leap from expected run-rate entering 2023. At 20% operating margin this would be £6m operating profit. Given the revenue level I have assumed no capital raise is required. Even in this scenario they would have experienced strong growth, and therefore applying 20x P/E produces a share price of 44p, around current levels.

The real upside from Surface Transforms would likely come in the outer years if they establish themselves as a real player in this exciting market. However, the start of that journey over the next few years is exciting too. If we assume 2025 revenue of £70m (based on current contracts plus carry over which they are pencilled in for, excluding prospective contracts and recent OEM 9 contract win), at 20% operating margin produces £14m operating profit. Assume 30m shares were issued to raise £15m for capex to have revenue capacity of £75m / year. Note if they are growing this fast, and hitting £70m revenue in 2025 they will need to have already funded further capex for future growth, I am not penalising them for this here given we are not recognising revenue past capacity and the business should be generating substantial cash to help self-fund growth. Applying a conservative 20x P/E, results in a share price of 89p, or 97% upside.

Illustrative simple calculation:

Note I have ignored net cash / debt, as this is limited currently, and not expected to be that material to the outcome (apart from the capital raise requirement factored in to the upside scenario). Further I have not discounted the future values.

Disclosure

Long Surface Transforms Plc at time of posting.

This post is not investment advice.

Post written prior to interim results being released, which contained a few points to highlight:

- In H2 2022 should hit run-rate sales £20m / year, this is very positive, as anticipated in the write-up.

- Revealed prospective contract pipeline lifetime value of c. £400m, mainly related to carry-on models.

- Sales guidance reduced for 2022, but increased by 10% for 2023-2025 mainly due to OEM 8.

- Expect to announce another significant new contract in what's left of 2022.

Some good analysis Alan.