PetroTal Corp. - timely investment idea

Debt repaid, dividends & buyback starting, strong recent production

Listed on London Stock Exchange AIM (PTAL); Toronto Stock Exchange (TAL); US OTC (PTALF).

Share price £0.465 / $0.58 (converted)

Market cap (diluted for warrants & performance shares) c$550m

Figures in USD.

Introduction

This write-up is short and simple, partly because it is a simple idea, and further as I am not an O&G specialist. Critique & questions welcome.

PetroTal Corp. is a small cap oil producer with a single operating field in Peru. They are set to distribute c12% to shareholders over the next year (c10% dividend, remainder buyback), supported from free cash flow. The market appears to miss that capex is dominated by growth / development capex this year, underlying free cash flow after maintenance capex only is c$100m higher (c18% of market cap). The company has made strong progress on successfully distributing their oil, with hopefully further progress to come, this would set the company up to maintain strong production, with potential for pre-growth capex free cash flow to approach c36% of market cap in the medium term.

Having just repaid their debt, now starting a significant capital return program, and strong recent production / distribution, now is a timely point to look at PetroTal.

Production & Distribution

PetroTal have historically struggled to find reliable commercial sales routes for the oil produced at the Bretana field in the Peruvian jungle. Last year they repeatedly missed / reduced guidance due to issues with social unrest and low river levels. It’s worth highlighting they are not having a technical problem producing decent quantities of oil, it is rather the export / sales side that has been tricky.

One issue has been local protests which they are seeking to address through a meaningful social trust fund being created to benefit the locals, this incentivises the locals to actually support production rather than block it, as they lose 2 days of social trust contributions for each 1 day disrupted. The Northern Peruvian Pipeline (ONP) is sometimes sabotaged as part of protests, or as a way to get work to fix it - locally the social trust may help, but not further afield.

The main export route currently in operation is along the Amazon river to Manaus, Brazil, where they have recently expanded their barging capacity to 20k bopd. This appears to be a breakthrough, operating reliably since the end of February 2023, enabling the company to export c20k bopd. Caution is required as we are now at the start of the dry season, and it is possible this will cause difficulties with low river levels.

The ONP reopened last month, after being shut down for over a year. Understandably PetroTal appear cautious about using this export route again, however they will consider once Petroperu’s credit lines are operating normally, they are also considering bypassing the initial section that gets the most damage.

Current guidance is for 14-15k bopd for 2023. While production was constrained in January & February due to barging normalising, production since has been c20k bopd - continuing in this vein would lead to beating current guidance, however management are waiting until August to consider revising, and alas if the dry season causes river level issues this may hinder beating guidance.

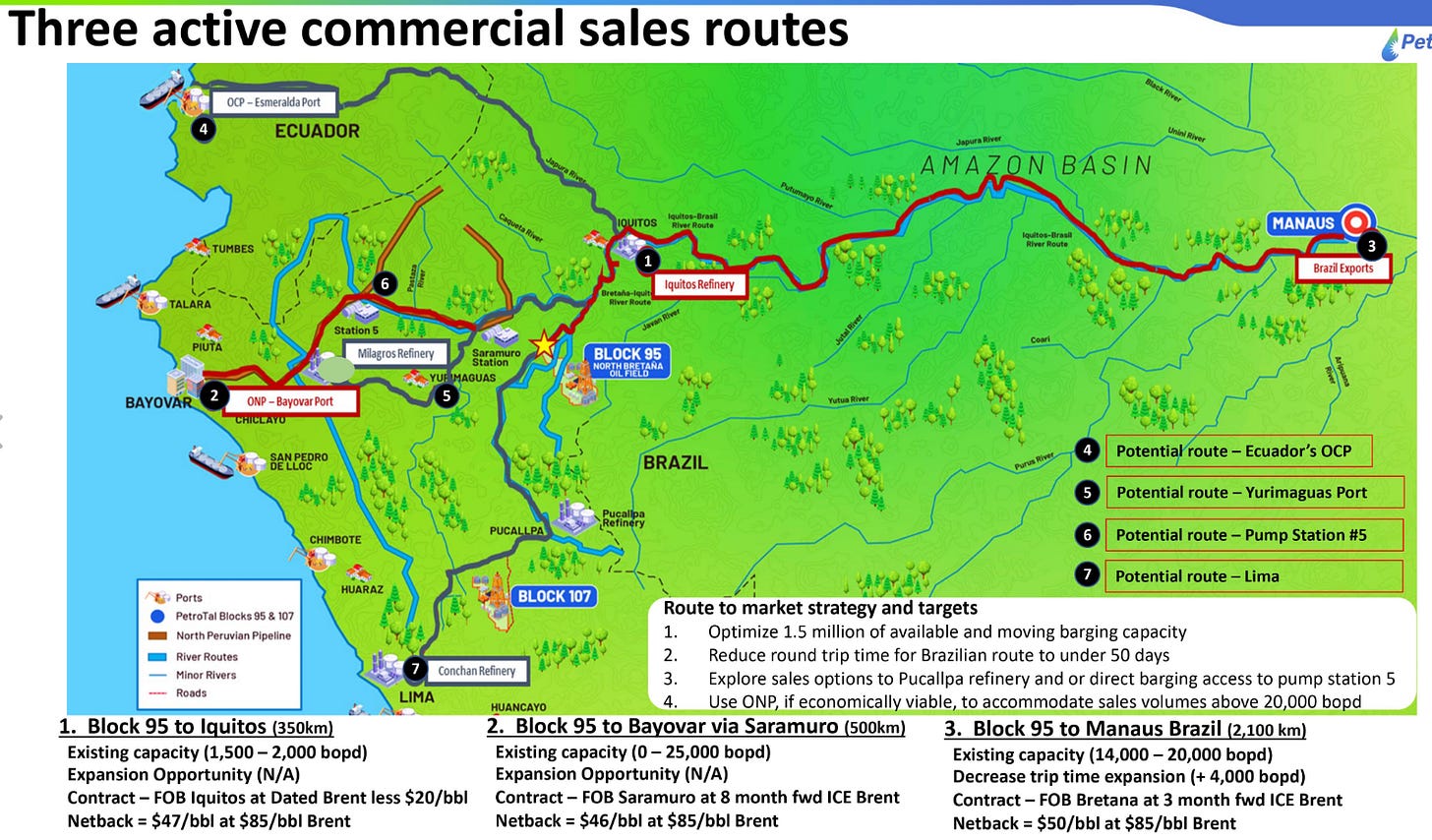

PetroTal are looking at adding other export routes (OCP Ecuador, Pump station 5, Yurimaguas, Lima), which if achieved could provide real distribution resilience, and see this key risk properly mitigated. The below slide from the Q1 earnings call shows current & potential export routes:

The Bretana field appears to have potential to operate either with high peak production up to 37k bopd, or to flatten this into multi-year production at 20-25k bopd, as detailed on the below PetroTal slide extract:

Perupetro provide hydrocarbon production figures here which include PetroTal, enabling investors to monitor PetroTal’s output between reporting periods, example of latest extract:

Financial Position & Downside

PetroTal has recently settled the final part of their outstanding bond for $80m, and is now debt free. Further, the expectation is that after providing shareholder returns of $70-80m in 2023, they will close the year with unrestricted cash in excess of $60m. This is assuming after tax free funds flow of $85m, which at mid-point of current guidance would require brent to average $85 / bbl, while brent is below this level currently, it’s also quite likely in my opinion that the company produces more than currently guided.

Given the strong financial position, and discretion to defer up to $40m of capex from 2023 (if low production and/or low brent price), my expectation is that the company has the ability to endure a lean period caused either by a low brent price, or distribution issues, without materially diluting shareholders.

In the short term, the shareholder returns for 2023 should be relatively safe, given a) conservative production guidance Vs recent barging success; b) they have some margin for error as they are expecting ending unrestricted cash over $60m Vs previously stated minimum liquidity balance of $50m. This provides some downside protection, as the shareholder return is c12%, including c10% dividend yield.

Upside

In recent months the company has made superb progress on managing to export c20k bopd, however it is too early to state they have cracked this, partially as we need time to see if social unrest is genuinely placated through the social trust fund, but more crucially the current solution is still subject to disruption from low river levels as we enter the dry season. However, given the progress to date, the fact the ONP is now open again, and the various options the company is exploring to add up to a further 20k bopd export capacity, I think it is reasonable to assume in the medium term they will be able to distribute at scale successfully.

Without getting deep into the figures (the company does provide a reasonable amount of information on per bbl costs, and netback per distribution route), it is clear from the below after tax free funds flow guidance that cashflow at 20k bopd should be significant. Particularly noting that 2023 capex of $125m, contains growth / development capex of $100m, and only $25m maintenance capex. Thus, assuming 20k bopd and $80-85 brent, it is not hard to see pre growth / development capex after tax free cash flow approaching $200m. This would be a pre growth capex FCF yield of c36%, against c$550m diluted market cap, with no debt, and a strong shareholder return policy. Without being precise, suggest 100%+ upside over the next couple of years.

Perhaps take with a pinch of salt, but the company highlighted on the recent Q1 call, that the shares are trading just above claimed PDP value per share, and clearly in a different ballpark to broker valuations.

Other Points

Peru country risk - will not be explored fully here, it is a volatile political environment with major protests occurring earlier in the year, see Bloomberg, WSJ. This is definitely an area for anyone interested to consider further. My understanding is the existing contractual agreements with PetroTal are meant to withstand changes to government, the real risk would be if a new constitution is agreed which overturns the prior setup. While of limited comfort, PetroTal is a Canadian company and thus if nationalised Peru would be required to pay the value of the company under the Peru Canada free trade agreement.

Exploration assets - PetroTal has exploration / development prospects to extend the Bretana field in Block 95, and at Osheki-Kametza. Apparently the company can get a ‘free look’ at Osheki-Kametza, through the value from historic tax pools relating to Block 107 being available should the drilled well be dry. These prospects contain substantial potential upside, however they are largely outside of the core thesis presented here. Importantly the company is effectively constrained on how quickly they can develop these prospects, due to regulatory constraints.

Single Bretana oil field - although progress to date at the field has been positive, there is obvious risk inherent in operating a single field.

Disclosure

Long PetroTal Corp. at time of posting.

This post is not investment advice & may contain errors.